Blog

Contact Us

At Credit Care of DMV, we don’t just repair, but also educate people about credit so that they never find themselves in that same situation in life.

How to Choose the Best Credit Repair Company in 2025 (And What to Avoid)

Are you struggling with bad credit? Looking for ways to improve your score?

Whether you’re hoping to qualify for a mortgage, secure better interest rates, or simply regain control of your financial future, professional help can make a big difference.

When you feel stuck, it’s okay to seek assistance—reputable credit repair companies can help fix errors on your credit report and deliver tangible results.

But with so many options out there, it's not easy to pick the right service provider.

Some promise quick fixes that violate the law, while others offer legitimate services that truly help. So, how do you choose the right one?

What are the telltale signs of a scam versus a reliable provider? Let’s look at the factors you need to consider to find the best credit repair company in 2025—and avoid costly mistakes along the way.

#1. Understand What Credit Repair Companies Can Do

Before you start evaluating your options, it’s important to understand what credit repair companies can and cannot do.

Credit repair companies assist in disputing inaccuracies on your credit report, negotiating with creditors, and providing tools for financial improvement.

However, they cannot remove accurate negative information or guarantee specific credit score improvements.

Watch Out for Red Flags

Companies that promise to erase legitimate negative marks or guarantee a certain score increase are likely scams. Under the Credit Repair Organizations Act (CROA), such claims are prohibited.

No company can legally remove legitimate late payments or bankruptcies. Yet, scams often claim otherwise.

#2. Look for Transparency in Services

A reputable credit repair company like AMERICA CREDIT CARE will clearly outline its services, fees, and limitations. Trustworthy credit repair service providers set realistic expectations about what they can achieve.

Credit repair service providers should offer detailed information about how they handle disputes, what tools they offer, and whether they provide personalized plans.

What to Avoid

Beware of companies with vague service descriptions or hidden fees. Vague or evasive responses are signs of trouble.

Transparency is a must—if they won’t answer your questions clearly, move on.

#3. Check for Compliance with CROA

The Credit Repair Organizations Act (CROA) protects consumers from predatory practices. So, make sure to verify CROA compliance before signing anything.

Legitimate credit repair companies must provide a written contract detailing their services and fees and offer a three-day cancellation period without penalty. They can only charge fees after delivering credit repair services.

Credit repair organizations that follow these rules demonstrate their commitment to ethical operations.

Beware Of

Companies that demand upfront payments or fail to provide a clear contract are violating federal law. If you hire them, you risk losing money to a company that may not follow through on promised credit repair services—or worse, disappear entirely after collecting your payment.

4. Research Reputation and Reviews

Customer reviews and ratings can reveal a lot about a credit repair company’s reliability. Look for feedback on platforms like Google Reviews, or the Better Business Bureau (BBB). Pay attention to complaints about hidden fees, poor customer service, or unfulfilled promises.

Be Cautious

Avoid companies that appear to have published fake reviews. Similarly, avoid credit repair service providers with numerous complaints or lawsuits.

#5. Compare Pricing Models

Legitimate credit repair companies typically charge monthly fees or per-item fees for disputes. Some may offer money-back guarantees if you’re unsatisfied with their services. Compare pricing across multiple providers to ensure you’re getting value for your money.

Be sure to read the fine print on dispute limits. Ask how many disputes they’ll file monthly. Opt for companies that prioritize high-impact errors first (e.g., collections over minor typos).

What to Avoid

Watch out for overly expensive plans without clear justification for the high costs. Also, avoid companies that fail to disclose their fee structure upfront.

#6. Evaluate Customer Support

Good customer service is a must when dealing with sensitive financial matters like credit repair. Look for companies that offer dedicated case managers, regular updates, and responsive communication channels.

What to Avoid

If they don’t pick up your calls, take too long to get back to you, or start evading your questions, stop right there. Companies that don’t provide clear communication or leave you in the dark about progress are not worth your time.

#7. Take Advantage of Free Consultations

Many reputable credit repair companies like AMERICA CREDIT CARE offer free consultations where you can discuss your needs and learn about their process.

Use this opportunity to ask questions about their services, timelines, and success rates. Free consultations allow you to evaluate the company’s expertise without financial risk

What to Avoid

Credit repair companies that pressure you into signing up during the consultation or refuse to answer detailed questions specific to your credit report should raise red flags.

High-pressure tactics often accompany credit repair scams designed to exploit vulnerable consumers who feel desperate to improve their credit quickly.

#8. Look for Additional Resources

Some credit repair companies go beyond basic services by offering personalized guidance. These extras can be helpful if you’re looking for long-term financial improvement.

Exercise Caution

Providers that focus solely on disputes without offering guidance on how to manage your finances moving forward may not be the best fit.

#9. Verify Legal Expertise

Certain credit repair companies employ attorneys or paralegals who specialize in credit law. They have an edge in handling complex cases like identity theft or legal disputes with creditors.

What to Avoid

Companies that claim legal expertise but lack proper accreditation or licensing should be avoided.

If a company advises you not to contact credit bureaus yourself or discourages you from learning about your rights under the Fair Credit Reporting Act (FCRA), this is a red flag.

#10. Watch Out for Suspicious Behavior

Unfortunately, scams are common in the credit repair industry. Be vigilant about warning signs such as:

Guaranteed results (e.g., Increase your credit score by 200 points in a month)

Fixed timeline to improve your credit score (Repairing credit takes time and depends on the nature of the errors being disputed.)

Upfront fees

Promises to remove accurate negative information like late payments, charge-offs, collections, etc.

Lack of transparency in contracts

No end date for services

If a company exhibits any of these behaviors, steer clear immediately.

Some companies may suggest creating a new credit identity using an Employer Identification Number (EIN) instead of your Social Security number or disputing accurate information on your report.

These practices are illegal and can lead to penalties. Engaging in such activities damages your credibility and financial future.

Final Words

Choosing the best credit repair company requires careful research and attention to detail. Focus on transparency, compliance with federal laws like CROA, and customer reviews when evaluating options. Avoid scams by steering clear of unrealistic promises and upfront fees.

Remember—you have the right to dispute errors on your own. However, if you need professional assistance, choosing a reliable credit repair company like AMERICA CREDIT CARE can save you time and effort.

LET'S TALK

Get in Touch.

Thank you for your interest in Credit Care of DMV. Please use the contact form to tell us about your inquiry and/or needs. We look forward to partnering with you.

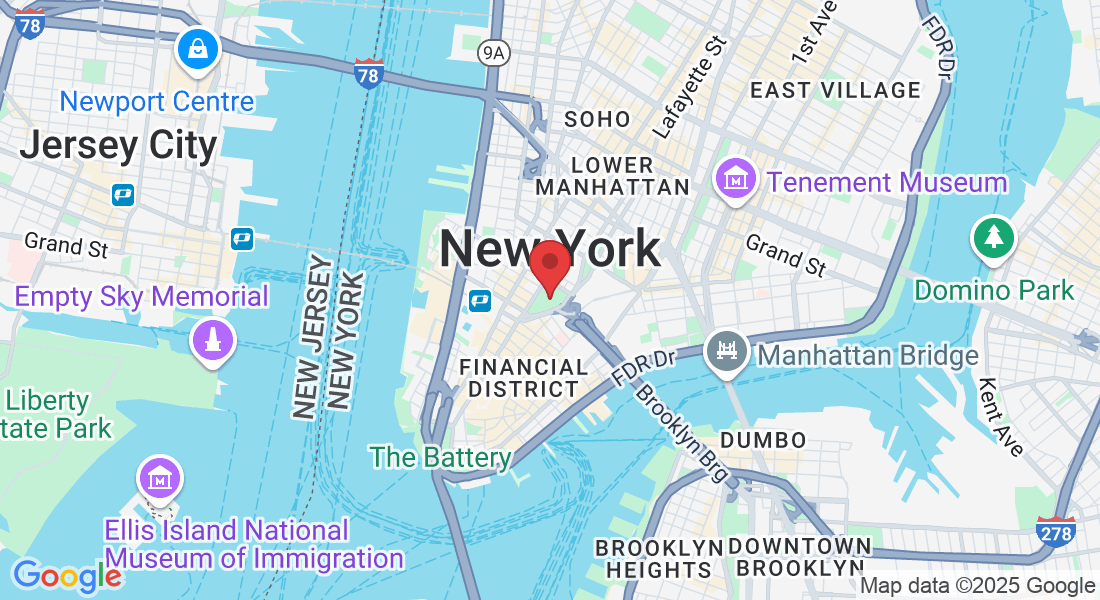

Office

NMLS ID 2423540

16701 Melford Blvd

Ste 400

Bowie, MD 20715

Email Us

Phone Support

+1 (240)-347-5995- Calls

+1 (240) 376-2552 - Text

Need help?

Don't hesitate to contact us.

We have many years of experience in evaluating credit and guiding consumers to assert their legal rights. We do it every day! We guarantee honesty and dependability, virtues which most people seem to have forgotten.

FREE DIY Credit Repair Toolkit!

Signup for our DIY Credit Repair Toolkit! Also get updates, promotions, news & insight about finance.

Copyright ©2026 America Credit Care. All rights reserved. Powered by WebbArtt Solutions

Legal Notice

NMLS # 2423540

Term of Use

Privacy Policy

Cookie Policy

We have many years of experience in evaluating credit and guiding consumers to assert their legal rights. We do it every day! We guarantee honesty and dependability, virtues which most people seem to have forgotten.

Copyright © 2026 America Credit Care. All rights reserved. Powered by WebbArtt Solutions